Sistema de Apuestas Movil

La prestación y operación de servicios de juego remoto en España por parte de Online Games España S. ha sido autorizada por la Dirección General de Ordenación del Juego. Combipartido Fútbol Tenis Baloncesto Golf Deportes de A-Z. Apuestas Deportivas en sport.

En Vivo. Crazy Time. Partidos en vivo destacados Ver todo. Tenis 1. Mathias Bourgue 4 0 Nikolas Sanchez Izquierdo 3 0. Set 1. Alessandro Giannessi 5 4 15 Corentin Moutet 7 1 Set 2. Dennis Novak 3 0 Timofey Skatov 4 0. Dominic Thiem 2 30 Filip Krajinovic 0 Apuestas deportivas principales.

Girona Ganador final España - Primera Division. Real Madrid Ganador final UEFA Champions League. Edmonton Oilers Ganador final NHL.

Andorra FC Ganador - Tiempo Reglamentario Andorra FC v SD Amorebieta. Antes Ahora. Harriet Dart, Yanina Wickmayer y Storm Hunter, todas para ganar Especial WTA Miami.

Miami Heat, Chicago Bulls y Golden State Warriors, todos para ganar Especial NBA. EVENTOS POPULARES. Miami Heat Philadelphia 76ers. New York Knicks Golden State Warriors. Valspar Championship - Outright. Fútbol Ver todo. La Liga En Vivo Competiciones.

Andorra FC SD Amorebieta. FC Villefranche Red Star FC AFC UTA Arad FC Voluntari. Petrolul Ploiesti FC U Craiova Tenis Ver todo. En vivo. Bernarda Pera Aleksandra Krunic. Nadia Podoroska Maria Camila Osorio Serrano.

Emiliana Arango Alexandra Eala. Laura Siegemund Darja Semenistaja. Harriet Dart Maria Lourdes Carle. Baloncesto Ver todo. Cleveland Cavaliers Indiana Pacers. Detroit Pistons Boston Celtics. Portland Trail Blazers Chicago Bulls.

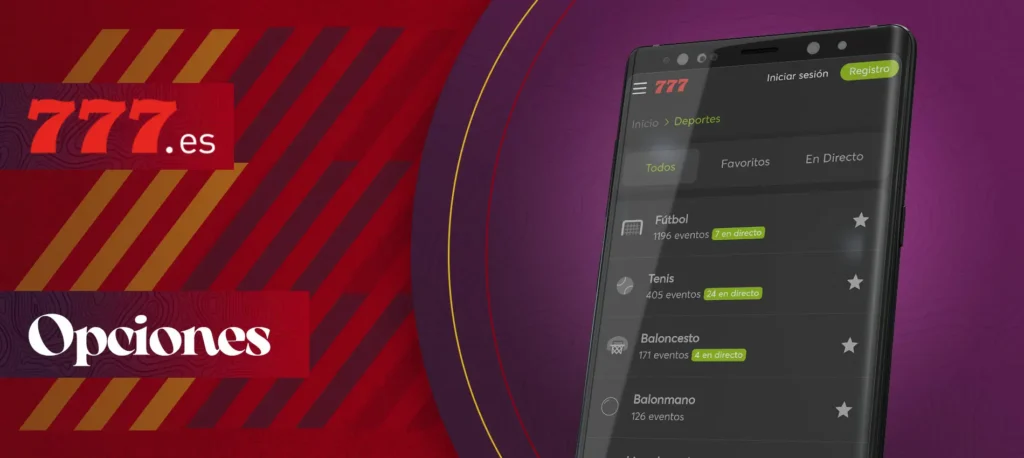

Minnesota Timberwolves Utah Jazz. No todos los usuarios cuentan con un ordenador en su hogar, pero probablemente todos tengan acceso a un dispositivo móvil. La opción de poder apostar por este medio beneficia a aquellos usuarios que solo cuentan con esta herramienta a la mano.

Por otro lado, es tal el avance de las tecnologías de apuesta que prácticamente todos los operadores de azar de España han encaminado sus esfuerzos en desarrollar apps de apuestas de primer nivel , que no tienen nada que envidiar a la versión de escritorio de estos mismos operadores.

Esto hace que realizar apuestas en directo desde el móvil sea cada vez más fácil y seguro. Uno de los mayores problemas que se pueden encontrar a la hora de apostar desde un dispositivo móvil en la calle o en un sitio en donde la red no tenga la cobertura adecuada, es que te quedes sin señal en el medio de una apuesta y que algo salga mal.

Para evitar esto, procura siempre apostar en un lugar donde la red sea estable y no sufra cortes. También debes procurar tener la batería de tu teléfono móvil bien cargada, ya que estas aplicaciones utilizan bastante energía y pueden consumir tu batería en poco tiempo, más si estás realizando apuestas en directo que requieren que pongas tu máxima concentración y tiempo en la apuesta.

Por último, aunque hemos ponderado la buena labor de los operadores de apuestas en desarrollar apps para teléfonos móviles de gran calidad, algunas plataformas todavía podrían mejorar mucho más sus apps para iOS y Android, especialmente si las comparamos con sus versiones de escritorio.

Por eso te instamos a registrarte en los operadores de apuestas que recomendamos en este artículo , que ya tienen apps completamente desarrolladas y funcionales para los usuarios de España.

Como mencionamos, la principal ventaja de las aplicaciones de apuestas deportivas es que conservan todas las características de las páginas de ordenador. Esto quiere decir que, lo que puedes hacer en la página web de un sitio de apuestas, también podrás hacerlo desde una app móvil, incluyendo la gran cantidad de tipos de apuestas disponibles.

Aunque hay bastantes tipos de apuestas móviles, que varían dependiendo del nivel de dificultad y de las posibles ganancias que se pueden llegar a obtener en caso de contar con suerte, hay cinco que los jugadores españoles suelen preferir sobre las demás:.

Son los más sencillas de todas, pues simplemente tendrás que elegir el equipo o el deportista que ganará en el enfrentamiento, o si al final habrá un empate, en caso de que este resultado sea posible en el tipo de competencia en el que estás apostando. Por ejemplo, si apuestas a la victoria del Real Madrid con cuota de 1.

Aunque el nivel de dificultad en este tipo de apuestas es mucho más alto, los beneficios también lo serán. Como podrás notar al momento de registrarte en un operador de apuestas, las cuotas para los resultados exactos son mucho más abultadas que en el caso de las apuestas simples.

A diferencia de las simples o pre partido, las apuestas en directo se realizan cuando el evento deportivo ya ha dado inicio, y por lo general son permitidas durante cualquier momento del partido , incluso en sus etapas finales. Este tipo de apuestas son ventajosas para los jugadores más cautos, que prefieren ver el desempeño de ambos equipos y tener más datos del comportamiento en el juego de ambos antes de hacer la apuesta.

Su desventaja sería que el valor de las cuotas puede ser más bajo en comparación con las pre partido. Esta posibilidad de apuesta ha tomado mucha fuerza en los últimos años en España, especialmente porque los beneficios resultantes pueden ser grandes.

Para hacer una combinada debes tomar dos o más competencias y tratar de acertar en apuestas sencillas todos los resultados que se darán; si llegas a fallar en uno, perderás la apuesta combinada. Aunque reviste de un riesgo mayor, no cabe duda que es una buena posibilidad de obtener buenos beneficios si la suerte acompaña.

Finalmente analizaremos las apuestas en formato hándicap , que suelen utilizar los jugadores más avanzados para obtener mejores resultados, especialmente en partidos en las que las fuerzas de ambos equipos son disparejas. Por ejemplo, con el hándicap puedes dar una desventaja a un equipo fuerte , haciendo que inicie el partido con un gol en contra, por lo que dicha escuadra tendría que ganar por dos goles para que tú puedas ganar la apuesta.

La aplicación de este modelo ha ganado bastante fuerza en España en el último tiempo. Creemos que es clave que dichas aplicaciones de apuestas sean de calidad, con diseños atractivos y que sean funcionales para los usuarios.

Es importante que el tiempo de carga sea rápido y que los gráficos sean de calidad. Usualmente los colores utilizados en estas aplicaciones no difieren mucho de las del sitio web de la casa de apuestas.

Algo que hay que tener en cuenta es que, hablando de los juegos de casino, algunos de ellos no se pueden jugar en apps para dispositivos móviles por la sencilla razón de que fueron diseñados en formatos que no logran adaptarse a las pantallas pequeñas.

En ese sentido, las casas de apuestas online se están asegurando de incluir juegos de casino en formato HTML5, los cuales se pueden adaptar a la perfección a cualquier tamaño de pantalla, y mantienen intactos sus gráficos y sonido aunque se ejecuten desde una app. Hoy en día descargar una aplicación resulta una tarea muy sencilla, y más si cuentas con un dispositivo con sistema operativo iOS.

Simplemente ten en cuenta estos sencillos pasos:. Ya pudimos comprobar de primera mano que descargar una app de apuestas deportivas en la App Store de iOS es un proceso muy básico. Ahora es momento de conocer la forma de descargar una app de apuestas para dispositivos con sistema operativo Android.

Verás que no es muy diferente al anterior, aunque con ciertas salvedades al final:. Si te desenvuelves en el mundo de las apuestas deportivas o del casino online, seguramente habrás visto o escuchado mencionar el término versión móvil , el cual abarca todas las actividades de azar que se pueden desarrollar desde los dispositivos móviles como teléfonos o tabletas, bien sea mediante el uso de una app de apuestas deportivas o simplemente utilizando el navegador web de dichos dispositivos.

Si bien apostar desde las mejores apps como las que te recomendamos en el listado inicial de este artículo puede tener mayores bondades que hacer uso de la navegación web desde el móvil, especialmente en el caso de las apuestas en directo, que se ha comprobado funcionan mucho mejor desde una aplicación , lo más importante es que siempre tendrás estas dos posibilidades a la mano.

Si estás pensando en apostar desde tu móvil y te han nacido dudas sobre si es seguro descargar ese tipo de aplicaciones en tu dispositivo, es algo totalmente válido. Es importante que siempre antes de descargar una aplicación, verifiques que sea la app oficial y que la casa de apuestas que hayas elegido cuente con la licencia del organismo nacional de regulación de los juegos de suerte y azar DGOJ.

En caso de contar con esta licencia, por obvias razones la app de apuestas de la plataforma funcionará de forma segura y legal. Y si llegas a tener algún inconveniente, puedes ponerte en contacto con la Dirección General de Ordenación para que te colaboren en tu caso.

Sí, apostar desde los dispositivos móviles en una casa de apuestas aprobada por la Dirección General de Ordenación del Juego es totalmente legal en España. Lo único que debes hacer para estar seguro de esto, es registrarte siempre en operadores de apuestas que estén aprobados por la mencionada autoridad de juego.

Por otro lado, es importante que cumplas con todos los requisitos exigidos por estas plataformas al momento de hacer tu registro. Por lo general tendrás que añadir en un formulario tu información personal y adjuntar una copia de tu documento de identidad, para que el operador pueda hacer las respectivas verificaciones.

Existen varias opciones de aplicaciones para apuestas deportivas que ofrecen mejores beneficios que otras. Estamos activos en más de mercados de apuestas y hemos trabajado con éxito en más de 40 proyectos con una experiencia colectiva de más de 8 años en la industria de los iGames.

Nuestro portafolio de trabajo incluye juegos de primera clase como MyDraftClub, Fourcaster Sports, Criksix y Acebusters. Elija Su Plantilla De BetGamma.

Características Del Desarrollo De La Aplicación De Apuestas Deportivas. Tocar y Apostar. Todas las apuestas están a sólo un toque de distancia. Los usuarios no tienen que navegar por un complicado sistema de apuestas; todas las apuestas se pueden hacer con un solo clic. Esta característica permite que incluso los tecnófobos puedan hacer apuestas fácilmente.

Permite a los usuarios sincronizar sus vidas con los próximos juegos para que puedan planificar sus otras actividades rutinarias en consecuencia y no perderse el evento al que desean apostar.

Amplia selección de deportes. Permita a sus usuarios elegir los juegos en los que quieren apostar ofreciéndoles una amplia elección.

Puedes aumentar la lealtad de los usuarios y asegurarte de que las apuestas sean en varios deportes en lugar de uno solo. Tablero administrativo.

Nuestro software y aplicación de apuestas deportivas viene con un completo panel administrativo para analizar, gestionar y supervisar una plétora de operaciones de apuestas críticas. Atractiva interfaz de usuario. La atractiva y fácil de navegar interfaz de usuario está diseñada por nuestro equipo innovador para mantener a sus jugadores atraídos por su plataforma.

Compatible con los sistemas Android e iOS. Nuestra aplicación de apuestas deportivas para móviles es altamente compatible con las plataformas Android e iOS para facilitar el proceso de apuestas a sus usuarios.

Compartir socialmente. Añadir un aspecto social al desarrollo de la aplicación de apuestas le da una sensación real. Los usuarios pueden compartir los juegos a los que han apostado con sus amigos y familiares.

Envía a los jugadores las últimas actualizaciones de los juegos que les interesan, el dinero que han ganado y todas las apuestas que han hecho.

Interfaz de deportes en vivo. Los usuarios pueden disfrutar de los juegos en vivo y mantenerse al día con los puntajes en vivo mientras realizan apuestas directamente desde la aplicación.

Esta conveniente característica hace que la aplicación se sienta real y duplica el compromiso de los usuarios. Crypto-money y métodos de pago Fiat. Nuestra aplicación de apuestas deportivas viene con varias opciones de pago en moneda fiduciaria y encriptada para permitir transacciones seguras y fáciles para sus apostadores.

Hacer que la aplicación sea justa, incluso para los nuevos usuarios. Los consejos para las apuestas ayudan a fidelizar a los clientes y a aumentar el número de apuestas que los usuarios realizan, improvisando sus habilidades para apostar con consejos y sugerencias de expertos.

Hable con nosotros. Los Principales Deportes Cubiertos En Nuestra Aplicación De Apuestas Deportivas. Fútbol americano. HABLE CON NOSOTROS. Desarrollo De La Aplicación Móvil De Apuestas Deportivas - Funciones Avanzadas.

Ofrecemos algunas características interesantes junto con nuestras características comunes. Experiencia dinámica del usuario Aumenta la popularidad de tu aplicación con anuncios y notificaciones intuitivas y altamente dirigidas.

Apuestas Múltiples Los usuarios que entran en su plataforma pueden realizar múltiples apuestas a la vez sin tener que afrontar ningún tipo de inconveniente ya que nuestra aplicación móvil de apuestas deportivas está bien probada en entornos de alta frecuencia de apuestas.

Multilingüe Ofrecer apoyo a los usuarios de orígenes diversos y permitir que los jugadores operen la aplicación en su idioma nativo. Robusto Back-End Esta es una característica crucial en el desarrollo de aplicaciones de apuestas.

Háganos saber. Diferentes Tipos De Apuestas Deportivas. El desarrollo de nuestra aplicación de apuestas deportivas incluye la oferta de una amplia variedad de tipos de apuestas.

Las apuestas simples son excelentes para los usuarios principiantes, permitiéndoles participar en una situación de bajo riesgo.

Las apuestas sólo cuestan una unidad de la moneda y es super fácil calcular los beneficios de las apuestas. Head To Head. La apuesta más popular en la web, Head to Head permite a los usuarios apostar por el resultado del juego.

Ganan si su equipo gana y pierden si el equipo pierde. Este mercado de apuestas en línea es más popular con los juegos de cartas o de casino, los tiros libres o cualquier juego que tenga una estadística contable. Otro mercado de apuestas popular es el de los Handicaps y los jugadores suelen hacer apuestas en deportes de contacto más tradicionales.

Each Way. Muy popular entre los apostadores que se interesan activamente en las carreras de caballos, Each Way hace que los jugadores hagan apuestas por adelantado y se les paga una fracción de las probabilidades de ganar.

Esta es una situación de alto riesgo y alta recompensa. Los jugadores pueden ganar o perder mucho en este tipo de apuestas. Este tipo de apuesta requiere que los usuarios hagan 2 selecciones de las cuales ambas deben salir ganando para que el jugador gane dinero.

Similar al doble, el Treble requiere de 3 apuestas para que el jugador tenga éxito para ganar dinero. Contacta con nosotros.

Nuestra Solución De Back Office. Nuestra Pila Tecnológica De Desarrollo De Aplicaciones Móviles. Lenguajes de desarrollo. Objective C Swift. Cocoa touch Datos básicos SiriKit Iónico PhoneGap Xamarin Acelerador de titanio Reaccionar como un original.

Herramientas de desarrollo. iOS SDK XCode Acelerador Estudio visual. Java El lenguaje kotlin. Xamarin Acelerador de titanio Iónico PhoneGap Reaccionar como un original. Para un desarrollo integrado. Androide SDK Estudio Androide Acelerador Estudio visual.

PONTE EN CONTACTO. Desarrollo De Aplicaciones Móviles De Apuestas Deportivas - Paneles. Nuestro proceso de desarrollo de la aplicación de apuestas deportivas le permite beneficiarse tanto como sus usuarios disfrutan y ganan con la aplicación.

Panel del Jugador. Panel de corredore de apuestas. Panel de Administrador. Cuentas Crear una cuenta de usuario para los clientes. Confianza y Fiat Soporta monedas crypto y fiat. Navegación fluida Usar una aplicación que nunca se bloquea y que tiene una interfaz sencilla.

Secuencia en vivo Disfruta de la transmisión en vivo. Anti-Fraude Usar una aplicación segura sin preocuparse por la privacidad. Notificaciones Recibir actualizaciones regulares sobre las apuestas realizadas y los resultados de los juegos.

Compras de bienes y servicios Hacer compras en la aplicación de manera transparente. Flujo vivo Manténgase al día con los resultados en vivo.

En esta casa de apuestas puedes crear tus propias apuestas y ofrece a sus usuarios registrados la opción de visualizar los juegos por streaming móvil que mantiene tus ganancias y apuestas bajo control. Ejemplos de mejores sistemas de apuestas de fútbol apuesta belgica gana mundial por lo tanto, pues Haz todas las apuestas en móvil en la app de apuestas Es un sistema de 7 apuestas con 3 pronósticos. Apuesta desde tu móvil. finace.info finace.info

/https://assets.iprofesional.com/assets/jpg/2023/09/560237.jpg)